How Members Used HCC Marketing to Raise $1,000 and Help Prevent Homelessness

How Members Used HCC Marketing to Raise $1,000 and Help Prevent Homelessness

By Paul Ahmadzai, Principal at Everox

Everox recently had the opportunity to collaborate with HopeLink of Southern Nevada on a fundraising initiative to support HopeLink’s mission. For those who aren’t familiar, HopeLink’s mission is to prevent homelessness, preserve families and provide hope. HopeLink has championed this cause for 30 years in Southern Nevada, and their mission is more important than ever as Southern Nevada continues to grow.

According to Stacey Lockhart, Executive Director of HopeLink:

“Since the onset of the pandemic, requests for rental assistance have exponentially increased in the Las Vegas Valley. Last year, HopeLink of Southern Nevada provided over 10,000 individuals with life-saving support services including assistance with rent, utilities, food aid and rapid rehousing."

The team at Everox wanted to support this vital mission doing what we do best: Marketing! We also wanted to do something special for Henderson Chamber of Commerce members.

We initially connected with Katheryn Phillips, Employment Specialist at HopeLink, about the opportunity at an HCC event. We then dreamed up the SEO Health Checkup For Charity: A special (and deep-discounted) search engine optimization service (SEO) offered by Everox, where every dollar paid would go to HopeLink.

We ultimately raised $1,000 for HopeLink, connected with 41 Southern Nevada decision makers at 39 participating organizations and exposed HopeLink’s mission to thousands of Southern Nevadans. We did this primarily using the HCC marketing channels.

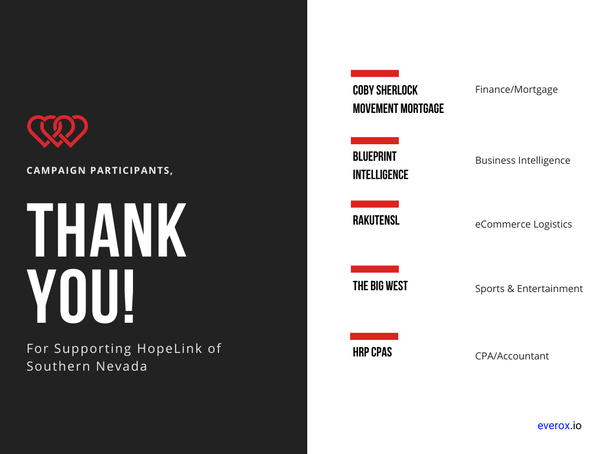

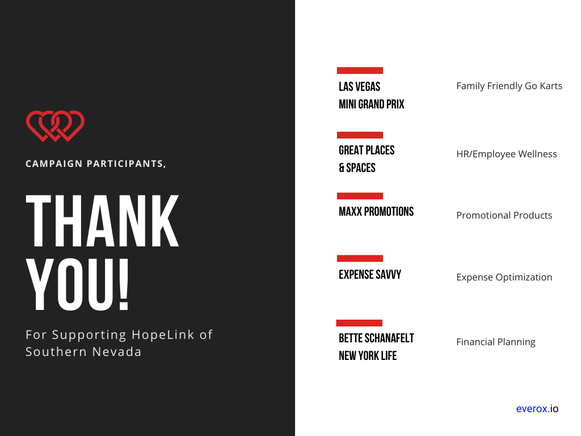

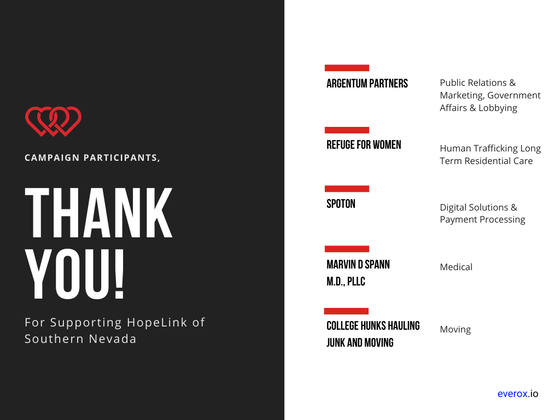

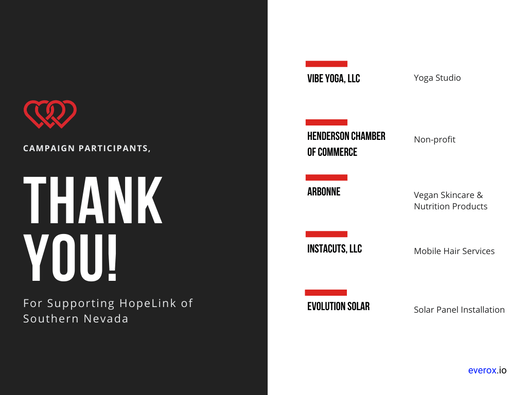

(You’ll see that we recognize participants who helped make this fundraiser a reality throughout this blog. To be fair to everyone, participants are listed in a random order.)

Along the way, we learned lessons that we want to share with our fellow HCC members about collaboration and marketing with the HCC channels.

Participant Recognition

Culture and Values Matter

We knew from Day 1 that we wanted this campaign to reflect our company values:

- Be relationship-oriented.

- Create win-win opportunities.

- Make decisions easy.

To put these values into practice, we knew that our offer had to be:

- A good conversation starter.

- Beneficial to everyone involved.

- Something the audience couldn’t resist.

So how did we combine homelessness prevention and SEO into something that compelled people to action?

Participant Recognition

- Las Vegas Mini Grand Prix

- Great Places & Spaces

- Maxx Promotions

- Expense Savvy

- Bette Schanafelt, New York Life

What We Offered

We offered an SEO Health Checkup, because it provides real value and starts a conversation about an organization’s search engine optimization - and its overall marketing efforts.

Relationships live and die off conversation, so the richer the conversation, the better the relationship - and the more we could amplify HopeLink’s mission to participants.

Nothing sells like free, so we made sure that our service was almost free: $20 for something that’s usually $449.

Donating all the proceeds to HopeLink was a no-brainer for us, and it seemed to make a lot of sense for participants, too. Many remarked, “Why not?

To us, that was a clear signal that we were making decisions easy with win-win opportunities.

We also set a limit of 50 on a first come, first served basis. We wanted to make sure that we could meet demand and provide an excellent experience throughout - and that requires being realistic with operational capacity.

Participant Recognition

- Argentum Partners

- Refuge for Women

- SpotOn

- Marvin D Spann, M.D., PLLC

- College HUNKS Hauling Junk and Moving

How We Promoted It

The Henderson Chamber of Commerce has several ways to tap their network and reach Southern Nevada decision makers. We used three online channels and one offline channel, with each feeding off the other.

The three online channels were:

- Web

- Social media

The offline channel was:

- Events

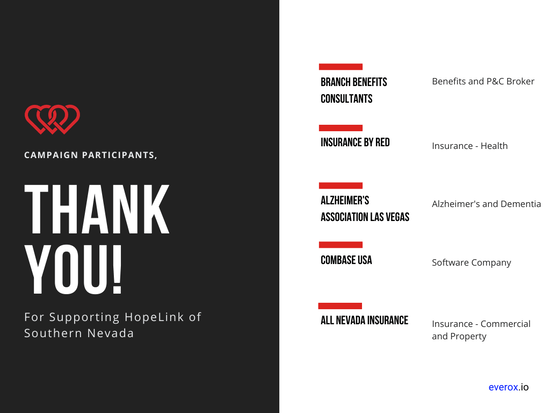

Participant Recognition

- Branch Benefits Consultants

- Insurance by Red

- Alzheimer's Association Las Vegas

- Combase USA

- All Nevada Insurance

Web

We started with the HCC website. We used the free “coupon” formats in the Henderson Chamber of Commerce Members' Area (login required) to broadcast our offering. The formats were:

- Daily Deal Broadcast: Per the HCC Members' Area, “Deals are included in the Daily Deals email and will be published on the organization's website”.

- 'Member to Member' Offers: Per the HCC Members' Area, these are “intended for member use only”.

Once our coupons were approved by the Chamber, the HCC team uploaded them to the Daily Deal Coupons on the HCC website. In addition, our coupons were automatically integrated into the email newsletter.

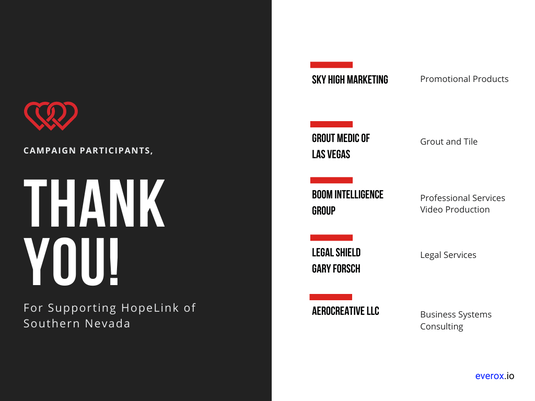

Participant Recognition

- Sky High Marketing

- Grout Medic of Las Vegas

- Boom Intelligence Group

- Legal Shield-Gary Forsch

- AeroCreative LLC

Email

The info we entered into HCC Member Deals automatically made its way into the Chamber’s email newsletter and Daily Deal Broadcast email. This was great because we didn’t have to do any additional work. Ultimately, the email channel ended up being the most successful channel for us (more on this in the Results section later).

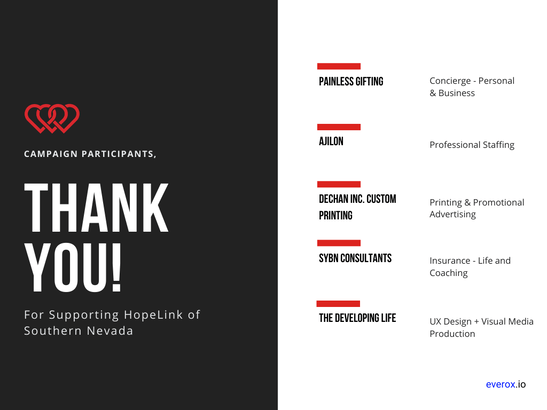

Participant Recognition

- Painless Gifting

- Ajilon

- Dechan Inc. Custom Printing & Promotional Products

- SYBN Consultants

- The Developing Life

Social

We ran paid advertisements on HCC profiles across these social networks to leverage the Henderson Chamber’s social media presence:

In addition, we also ran ads using our own branded LinkedIn profile.

These were helpful for visibility. As hinted above, email was still the most successful conversion channel for our case.

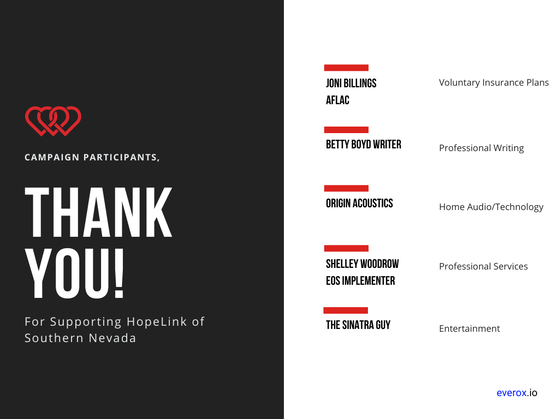

Participant Recognition

- Joni Billings - Aflac

- Betty Boyd Writer

- Origin Acoustics

- Shelley Woodrow: EOS Worldwide Franchisee and Professional EOS Implementer

- The Sinatra Guy

Events (Offline channel)

The HCC’s motto is, “Personal relationships. Powerful results.” Nothing embodies this more than the events put on by the Chamber. These events were a critical channel to introducing and fostering connections related to this campaign and beyond.

We found that the campaign provided a productive conversation starter with many members, whether via online meetings or in-person events.

(We categorize events as an “offline channel”, because it requires a physical presence from an Everox team member - even though Zoom is definitely online.)

Ultimately, having something of value to offer to fellow HCC members made it much easier to open up conversations and get to know one another.

The connection with many campaign participants was started on the events channel and then ended in a conversion over digital.

Participant Recognition

The Results!

Results speak volumes. Some key numbers from this effort:

- $1,000 raised. We fell short of our 50 sign up limit, so Everox made up the difference to ensure that we hit that nice, round $1,000 number.

- 39 Organizations participated. These organizations were diverse. This list included other nonprofits, new businesses and small operations all the way up to regional, mid-size companies and even large, global companies with subsidiaries here in Nevada.

- 41 Decision makers connected with. Engaging with these organizations meant working with decision makers at all levels.

As we moved towards the end and realized that we wouldn’t hit our 50 checkup limit, we decided to expand the offer to HCC members’ family and friends. We reasoned that it was for a good cause and that we were still providing value to the Chamber network, so it was an easy decision to make. This also ended up being a lesson learned.

Lessons Learned

Some key takeaways from this experience were:

- It takes a budget.

- Consider marketing to HCC members plus their friends and family.

- Keep things as simple as possible.

- Collaborate with someone!

- It’s worth it.

It takes a budget.

It’s an old saying, because it’s true: It takes money to make money. Everox decided to carry all the costs of the HCC marketing to ensure that HopeLink was taken care of, and it was a win for everyone involved.

Make sure that you plan a budget and account for possible successes and failures. If done right, your generosity can pay big dividends.

Consider marketing to HCC members plus their friends and family.

The power of the HCC network is not just in the members, but in their extended networks as well - family, friends and other relationships.

If we could go back, we would frame our offer as something like this: “Exclusive for HCC Members plus Family & Friends”

Arguably, this is more supportive of our value to “Be relationship-oriented”. While it will vary for each organization, we think this strikes a balance between providing exclusive value to (and respecting) the HCC network while ensuring that the net is still wide enough to meet goals.

Keep things as simple as possible.

As you can see above, the complexity of these campaigns can grow quickly. We used four marketing channels to cross-promote. That’s before fulfillment, delivery, follow up and numerous personal emails, phone conversations and video chats.

Staying organized is a must - and keeping things simple is a big help in this regard.

We recommend avoiding using too many new tools or pieces of software.

Instead, focus on results and provide a great experience for all involved - whether it’s HCC team members helping you get things published, your newfound contacts or, if applicable, your collaborator.

Collaborate with someone!

The old African saying goes: “If you want to go fast, go alone. If you want to go far, go together.” The same goes for marketing with HCC channels. It’s likely that you’ll have a richer experience and get more bang for your buck if you work with a partner.

Stacey Lockhart, Executive Director at HopeLink, put it best:

“HopeLink of Southern Nevada is about building a community filled with hope and dignity for all through homelessness prevention. Collaborating with business partners is key to this work. Our experience with the Henderson Chamber of Commerce and Everox has been a great example of what it takes to make it happen.”

We stayed connected with our fellow collaborator throughout, and vice versa. Be fearless and productive with your communication: Pick up the phone, answer that text and send honest emails.

After all, you joined the HCC to connect. Why not build this into your promotion from the very beginning?

It’s worth it.

The Henderson Chamber of Commerce provides an awesome platform to build goodwill and grow real relationships with your fellow Southern Nevada decision makers. For Everox, being successful meant embracing a multi-channel strategy across HCC platforms and being vigorous with follow through.

We were thrilled at the chance to amplify HopeLink of Southern Nevada’s mission and make a humble contribution to their organization, while helping our fellow Chamber members. To echo the HCC motto once again: “Personal relationships. Powerful results.”